Nonprofit Accounting Resources

Stay up to date with industry trends, development tactics, and management tips. Lead your nonprofit with confidence this fiscal year.

Understanding a Nonprofit Statement of Activities

As an Executive Director, it's crucial to understand your nonprofit's finances. This knowledge helps you achieve a positive bottom line and stay transparent with the people who support you. A critical tool in achieving both of these things is the Statement of...

What is a Fractional Executive?

In the ever-evolving world of business leadership, the term fractional executive has become incredibly important. These are experienced C-suite professionals who use their extensive knowledge to help multiple companies on a part-time basis. Instead of working...

Step-by-Step Guide for Completing 1099 Forms in Quickbooks Online

Step-by-Step Guide for Completing 1099 Forms in Quickbooks The 1099 Form in QuickBooks is essential for reporting nonemployee compensations and third-party payments during the calendar year. It tracks payments to independent contractors and others not on the regular...

Can an LLC be a Nonprofit?

Can an LLC be structured as a nonprofit? Yes, it can. However, it's not easy and requires precise legal and financial regulation. An LLC, commonly linked with for-profit enterprises for its flexibility and limited liability, can adapt to serve nonprofit purposes. This...

How to Integrate your Chart of Accounts in Quickbooks

Effective financial management is vital for nonprofit organizations, and at the heart of this lies a well-organized chart of accounts. It's not just about keeping accurate records but also about gaining meaningful insights into your financial health. QuickBooks, a...

How to Update Quickbooks with a 2024 Budget

Budget management is a cornerstone of nonprofit organization success. It not only ensures financial stability but also aligns spending with the mission and objectives of the organization. As we enter 2024, updating your budget in QuickBooks is crucial to maintain this...

Fundraising Strategies for Nonprofits

In nonprofit management, generating sustainable funding is crucial for growth and making a significant impact. This goes beyond basic financial needs; it's about enhancing your mission and reach. As executive directors and CEOs, you play a key role beyond just...

Navigating the Complex Terrain of Tax Compliance: Overcoming Common Challenges

In nonprofit management, generating sustainable funding is crucial for growth and making a significant impact. This goes beyond basic financial needs; it's about enhancing your mission and reach. As executive directors and CEOs, you play a key role beyond just...

How to Prepare a Financial Report for your Board of Directors

In the nonprofit sector, the board of directors plays a crucial role in guiding the organization's mission and financial stability. Key to their effectiveness is access to clear and comprehensive financial reports. These reports are vital for strategic planning,...

Using Quickbooks for Nonprofit Payroll

Efficient financial management is pivotal for nonprofits, especially in handling payroll. Nonprofit payroll help extends beyond mere payment processing; it involves maintaining financial integrity and adhering to both legal and grant standards. For nonprofit leaders,...

How to Start a Nonprofit in Nebraska

Nebraska is home to a thriving community spirit that often translates into a strong and growing nonprofit sector. Nebraskans are increasingly turning towards nonprofit organizations as vehicles for change, community support, and social good. However, embarking on the...

Understanding Indirect Cost Allocations

In the world of nonprofit organizations, financial transparency is a critical factor in maintaining trust and building strong relationships with donors. One effective way that can enhance financial transparency is the Indirect Cost Allocation Table. This powerful tool...

End of Year Fundraising Campaign Guide

What is an End of Year Fundraising Campaign? End-of-year fundraising campaigns are more than just a last-minute rush to raise funds. They signify a crucial window of opportunity. The final months, especially December, witness a surge in philanthropy, with many...

How to Manage & Report In-Kind Donations

How to Manage & Report In-Kind Donations In the world of nonprofits, monetary donations often take the spotlight. However, in-kind donations are just as crucial to many organizations. These contributions, which encompass goods, services, or time rather than direct...

Nonprofit Balance Sheet Guide & Template

What is a Nonprofit Balance Sheet? The Nonprofit Balance Sheet or Statement of Financial Position reflects the financial stability of the organization. It allows stakeholders, including donors, grantors, board members, and management, to assess the organization's...

Nonprofit Audit Checklist

The financial health and transparency of a nonprofit organization is paramount, not only for the leadership and beneficiaries but also for donors, sponsors, and the public. A nonprofit audit is an essential method for maintaining transparency and accountability. This...

Statement of Functional Expenses Template for Nonprofits

Managing and presenting financial information accurately is essential for any organization. For nonprofit entities the statement of functional expenses (often referred to as a SOFE) is not just crucial; it's often mandatory. This statement provides a breakdown of how...

Fractional CFO Job Descriptions: A Guide for Small Business Owners and Nonprofits

Updated: April 1, 2024 For small business owners and nonprofit executive directors, successful financial management is key to long-term success. Even if you have a bookkeeper or accountant, your organization still may require more specialized advice. If you don't have...

10 Financial Ratios Every Small Business Owner Should Know

Understanding and analyzing financial ratios is crucial for small business owners looking to improve their financial performance. These ratios provide valuable insights into a company’s profitability, liquidity, efficiency, and overall financial health. By mastering...

The Digital Shift: Understanding Virtual CPA Services and Their Impact on Accounting

Running a successful nonprofit or small business requires a great deal of time, effort, and resources. One of the most crucial aspects is managing finances effectively in order to grow at a consistent rate. However, for many small and medium-sized organizations,...

1099 Master Guide for Businesses

As a business owner or accountant for a business, understanding the intricacies of tax reporting and compliance is crucial. One area that requires special attention is the 1099 form. Whether you hire an independent contractor to help with bookkeeping or work as a...

Nonprofit Accounting FAQs

Nonprofit Accounting Basics

Accountant or Bookkeeper – What’s the difference?

A bookkeeper handles the daily data entry to provide a foundation for an accountant’s high-level analysis. They handle the basic financial information for an organization and keep an eye on a nonprofit’s budget, payroll, and transactions. Also, bookkeepers typically reconcile bank accounts and recurring expenditures.

An accountant has more expertise and serves in a more advanced role. They prepare tax returns and act as a link to tax authorities. They build budgets and project the growth of an organization. Accountants also provide analysis and financial insight to a CEO and Executive Director. Their work is built on the daily financial information that a bookkeeper provides.

Accountants perform a more complex job and provide nonprofit leadership with essential financial information. If you need support, hire a Certified Public Accountant or a nonprofit accounting firm.

What is the difference between nonprofit and for-profit accounting?

Nonprofit accounting is based on a different set of principles and regulations. Nonprofit accounting is socially responsible, while for-profit accounting focuses on generating a profit for investors. An accountant working for a nonprofit must understand the organizational structure, mission, goals, and objectives, as well as relevant laws and regulations governing the organization’s operations.

Nonprofit accounting focuses on how an organization executes its programming and operations. In comparison, for-profit accountants focus on revenue. Taxes are also very different for both. Nonprofits are not required to file financial statements or tax returns with the government, while businesses had more complex tax protocols.

Budgeting and Forecasting – Does a nonprofit need to do both?

For effective nonprofit accounting, you have to do both budgeting and forecasting. Budgeting is considered a plan of predicted revenues that an organization will achieve in the future. Financial forecasting, on the other hand, anticipates the amount of revenue or income that will be generated at a future time.

Ever had a plan that didn’t go exactly how you wanted it to? We all have…

A nonprofit must implement a budget to achieve its goals and missions, as well as manage its cash flow for sustainability and growth, and for the board of directors to meet their fiduciary responsibilities. Forecasts make it easier to deploy working capital in response to new opportunities and anticipate change.

Does my nonprofit need a Chart of Accounts?

A chart of accounts (COA) serves as the foundation for your organization’s financial statements. A COA informs stakeholders, funders, and executives of an organization’s financial position. It can also serve as a financial literacy tool for program staff and assist management in creating an effective budget for their programming.

What is Cash Basis Accounting? How is it different from Accrual Accounting?

Nonprofits can use one of two accounting methods– cash basis or accrual basis. Cash basis accounting is often used by smaller nonprofits that have low levels of activity in their operations. This method records income when an organization receives cash. Expenses are reported the moment they’re paid. Cash basis accounting keeps track of working capital, which can be useful in planning operations and future programming.

Accrual accounting is a type of accounting in which income and costs are recorded when earned or incurred rather than received or paid. Oftentimes, the expectation is that money will be paid in the future. Expenses are reflected on the period that best matches the funding they helped create. Accrual basis accounting can provide an organization with a complete financial picture by understanding its different assets.

Reporting & Organizational Health

What is a Statement of Cash Flow?

A nonprofit statement of cash flows is a financial report that shows how money flows in and out of an organization regularly. Ideally, the report is generated monthly. The key components of a strong cash-flow statement are:

1) An accurate balance sheet—the difference between assets and liabilities.

2) A detailed description of all cash receipts and payments, including when they occurred and what type of payment was made (e.g., check, credit card, etc.).

3) An explanation of why each category is included in the statement.

4) A clear explanation of any non-cash adjustments used to improve reported results (e.g., depreciation).

What is the difference between an Income Statement and a Statement of Activities?

An income statement presents a snapshot of a nonprofit’s financial performance. It shows how much money is actually coming in and going out during a specified period of time. A Statement of Activities compares revenue and expenditures for a fiscal year, breaks down expenses by function and net assets released from restrictions, and lists an organization’s net assets at the beginning and end of the year.

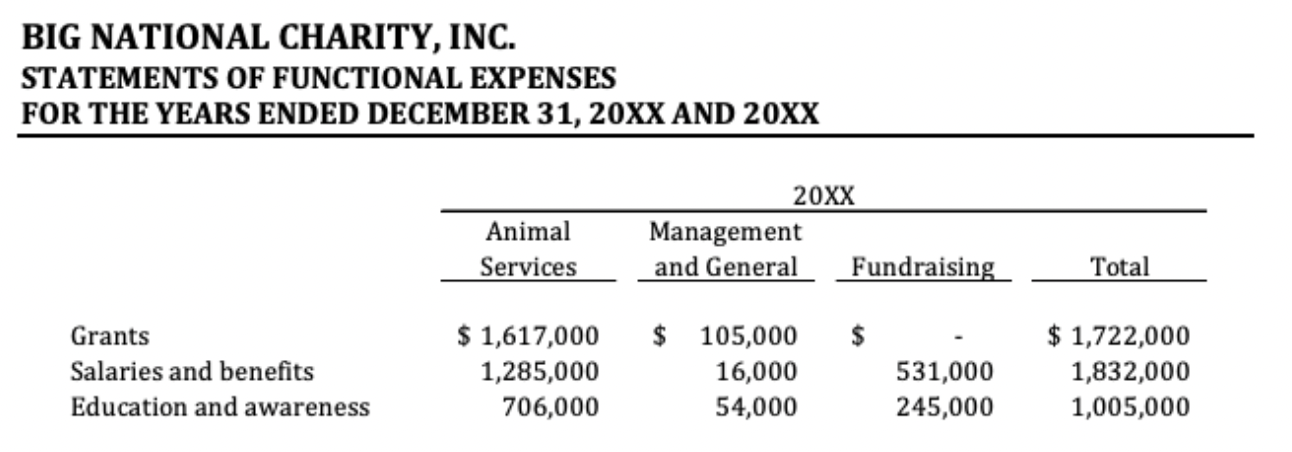

What is Functional Expense Allocation?

Consequently, the method by which a nonprofit organization’s accountant or bookkeeper classifies each expense according to its functional classification is known as functional expense allocation.

The functions typically seen in nonprofit financial statements are each of the programs, and the supporting services such as Administration and Fundraising. Review the sample statement below to see how this might apply to your nonprofit.

What is a complete set of Financial Statements?

A complete set of nonprofit financial statements includes 3 statements– a Statement of Financial Position, a Statement of Activities, and a Statement of Cash Flows.

A Statement of Financial Position shows total assets, total liabilities, and net assets (broken down into net assets with and without donor restrictions). It analyzes the financial health of your nonprofit.

A Statement of Activities that details recognized revenue and expenses

A Cash Flow Statement discloses how much money has been raised and how much money has been spent during a specific period, and breaks those flows down into operating, financing, and investing sections.

What is Fund Accounting?

Fund accounting refers to the process of tracking and reporting your expenses against the associated funding raised for that purpose.

When a donor donates, they can specify whether the money is restricted or unrestricted. When a donation is unrestricted, it means that a nonprofit entity can use it for whatever it wants. When a donation is restricted, the nonprofit must use the funds for the purpose designated by the donor.

Fund accounting is used for increasing financial transparency, ensuring accurate financial records, and tracking the organization’s performance to provide a clear picture of its financial position.

Nonprofit Management

Does my nonprofit need to hire a Certified Public Accountant (CPA)?

You’ve heard the saying, “An accountant is someone who makes sure your numbers add up.” A CPA takes it a step further. Contracting a CPA can be useful when you want to raise more funds, start a new program, or audit existing books. They will simplify complex accounting procedures and provide valuable support. They can help with establishing procedures, processing payments, and handling payroll paperwork. A CPA can also offer guidance on tax compliance.

What percentage of my organization’s budget should be allocated toward salaries?

According to Charity Navigator, a popular site used by many funders to evaluate nonprofits on their financial efficiency, 7 out of 10 charities evaluated spend at least 75% of their budget on the staff that executes the programs and services they exist to provide. Charity Navigator has metrics for fundraising efficiency. Based on the size of your organization, it should be between 3-10%. Therefore, it is advised that you review your expenses while taking this criterion into account.

What are internal controls and how should my nonprofit integrate them?

Internal controls are procedures that a nonprofit has in place to ensure that all its financial activities are compliant with the organization’s mission, goals, and objectives. They help control financial transactions; prevent fraud, errors, and overspending; track assets and liabilities; and simplify administrative tasks.

All nonprofits should implement an adequate internal control system. The best way to ensure that you have strong internal controls is to start with a solid plan. First, identify your organization’s goals and objectives with regard to internal controls. Next, determine your organization’s strengths and weaknesses such as the size of your staff. After understanding these two things, you can create a detailed internal control plan to support your organization’s financial goals.

What software should nonprofits use to manage their finances?

QuickBooks, Xero, or Aplos, work well for smaller nonprofits that have simple accounting needs. We recommend Quickbooks Online.

Larger organizations require a more advanced software like Blackbaud. Deciding on which software to use (and pay for) is an important decision. If you’re having trouble deciding which to move forward with, let’s chat!

What does it mean to outsource accounting?

By outsourcing accounting, you are giving a third party the responsibility of managing your organization’s financial records. Outsourcing is a great way to free up valuable time and resources so that you can focus on other important tasks. Another benefit of outsourcing is that it gives you peace of mind knowing that your books are being properly kept and maintained by a professional.

If you outsource your nonprofit’s accounting to Velu, you will benefit from years of experience and collective expertise. You will receive accurate and timely information to keep you informed about your financial health by creating a services package tailored to your nonprofit’s needs.

Tax & Compliance

Which Form 990 does my organization need to file?

Almost all nonprofits are eligible for tax-exempt status. The IRS uses the information collected by Form 990 to confirm that the organization is meeting its objectives and can maintain its tax-exempt status.

Various types of form 990s must be filed depending on the size, annual gross, and income of the nonprofit. The four most common IRS Form 990 forms are Form 990-N, Form 990-EZ, Standard Form 990, and Form 990-PF.

- 990-N– filed by small tax-exempt organizations with annual gross receipts of $50,000 or less.

- A 990 EZ– filed by slightly bigger entities with a gross income of $200,000 or less and total assets of $500,000 or less.

- Form 990– filed by larger nonprofits with gross receipts of $200,000 or more and total assets of $500,000.

- 990- PF is for private foundations, regardless of their amount of capital or assets.

What are Generally Accepted Accounting Principles (GAAP) Standards? Do nonprofits also follow them?

GAAP, or Generally Accepted Accounting Principles, are guidelines that cover the best practices of commercial, corporate, and nonprofit accounting. Both businesses and nonprofits follow GAAP standards.

The purpose of GAAP is to ensure that financial statements are easier to read for investors, funders, and the government. Nonprofit GAAP requirements provide transparency for funders and assist the government in determining whether an organization should keep its tax-exempt status.

How frequently should nonprofits conduct an audit?

A nonprofit’s financial audit is an important part of ensuring that the organization has accurate accounting records and is legally compliant. A yearly audit ensures that the organization can accurately track its financial activities and comply with changes in laws and regulations. The frequency of audits depends on several factors, including the size of the organization, the type of activity it undertakes, and how it distributes its financial data. In general, most nonprofits should conduct an annual audit when their budget and operations support it.

Audits can uncover a wide range of problems, from errors in accounting records to violations of fundraising and spending limits. Auditors can also help nonprofits identify opportunities to improve their operations and fundraising. Finally, audits are an essential tool for nonprofits seeking to build public trust and confidence. By demonstrating fiscal responsibility, nonprofits can earn the trust of donors and strengthen their ability to further their mission.

What is the difference between an audit, a review, and a compilation?

An audit is the highest level of attestation services an independent CPA firm will provide that includes an examination of an organization’s financial operations, management controls, and tax compliance. In a standard audit, auditors will produce

a report of all the organization’s financial information (for example, a Statement of Financial Position, Statement of Activities, Statement of Cash Flows, and related footnotes) and attest they are free from material misstatements. Medium-sized to large nonprofits typically want an audit done every year for external stakeholders such as funders to show financial accountability.

A review is like an audit. It is an objective evaluation of an organization’s financial records and management processes. Unlike an audit though, a review may focus on a certain area or program within the organization. The reviewer must perform analytical procedures and make inquiries concerning the financial statements and accompanying footnote disclosures. This is a lower level of attestation service (and thus provides lower assurance) than an audit but conducts more testing than a compilation to ensure accurate financial reporting. A review may be a better option for smaller to medium-sized nonprofits whose budgets may not support a full audit, but want to show financial accountability to potential funders or other external stakeholders.

A compilation is one of the lowest levels of attestation services a CPA can provide and provides essentially no assurance as to the accuracy of the financial reports. Typically, the CPA won’t do any testing or analytical procedures but will examine details such as bank statements and loan documents. Your nonprofit may have a CPA perform a compilation if formal financial statements are needed for internal purposes or a bank loan.

What are the latest nonprofit accounting standards my nonprofit should be focusing on?

- Accounting Standards Update (ASU) 2016-14, Presentation of Financial Statements of Not-for-Profit Entities: This statement provides guidance on how nonprofits should present their financial statements.

- ASU 2016 – 18 Restricted Cash: This statement requires that restricted cash and restricted cash equivalents be included as components of total cash and cash equivalents as presented on the statement of cash flows.

- ASU 2018 – 08 Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made: This statement provides guidance in evaluating whether transactions should be accounted for as contributions or exchanges. It also introduced the concept of barriers in providing additional guidance on identifying conditions that would preclude the recognition of a contribution as revenue.

- FASB ASC Topic 842, Leases: Does your organization lease its space? If so, this is an important standard to adhere to. Organizations must now report the assets and liabilities associated with their leases each year.

Let's Chat

Questions? Ready to get started? Book some time with Tyler Wilcox, CPA.

We're here for you and your nonprofit.