Managing a nonprofit organization comes with unique challenges, especially when navigating tax forms and compliance. One essential form you may encounter is the Form W9. Although it is often associated with businesses, the Form W9 plays a significant role for nonprofits too. This guide will walk you through everything nonprofit leaders need to know about the Form W9, from its purpose to how to complete it correctly.

What is the Form W9?

The Form W9, officially titled “Request for Taxpayer Identification Number and Certification,” is a document issued by the IRS. It’s primary purpose is collecting taxpayer information, such as their name, address, and Taxpayer Identification Number (TIN). For nonprofits, the form may look different depending on the type of organization and the nature of its tax-exempt status. It is crucial to understand the nuances of the Form W9 to ensure compliance with IRS regulations.

Key points to understand about the Form W9:

- An entity typically requests it by paying another party for services or goods.

- It is not submitted directly to the IRS but is retained by the requesting entity.

- Completing this form helps ensure accurate 1099 reporting at year-end.

Why the Form W9 Is Important For Nonprofits

The Form W9 serves several important functions:

1. Verifying Tax-Exempt Status:

- Nonprofits often use the Form W9 to confirm their tax-exempt status with vendors or contractors. This is especially true for 501(c)(3) organizations, which have a unique designation under IRS rules.

2. Ensuring Accurate Reporting:

- When nonprofits pay independent contractors or vendors $600 or more in a tax year, they must issue Form 1099-NEC. A completed W9 ensures the proper Taxpayer Identification Number is recorded for 1099 purposes.

3. Maintaining IRS Compliance:

- Filing errors can lead to penalties. A properly completed W9 minimizes the risk of compliance issues for the nonprofit and the vendor.

4. Building Trust:

- Providing a completed W9 demonstrates professionalism and transparency, which can enhance trust between your organization and your business partners.

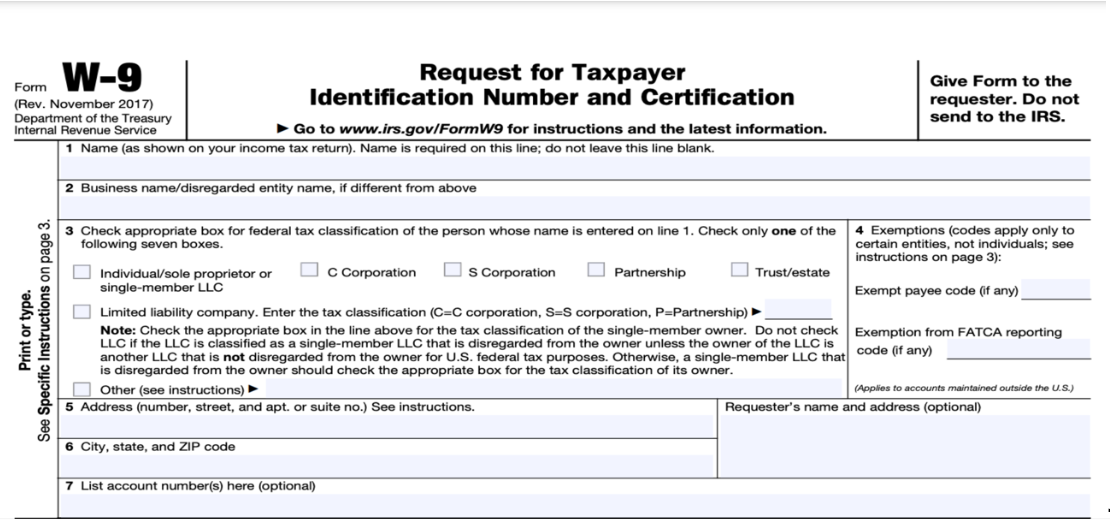

Who Should Complete Each Part of the Form W9?

Understanding the sections of the Form W9 will help ensure it is completed correctly:

1. Name:

- For a nonprofit, this should be the organization’s legal name as it appears on IRS records.

2. Business Name/Disregarded Entity:

- If your nonprofit operates under a different trade name or DBA (Doing Business As), include that here.

3. Tax Classification:

- Most nonprofits will check the “Other” box and write “501(c)(3)” to indicate tax-exempt status.

4. Taxpayer Identification Number (TIN):

- Enter the nonprofit’s EIN (Employer Identification Number). This is critical, as nonprofits do not use a Social Security Number (SSN).

5. Certification:

- The form must be signed by someone authorized to represent the organization, such as an executive director, CFO, Fractional CFO, or board member.

When Should a Form W9 Be Completed?

Nonprofits and their vendors should complete a Form W9 in the following scenarios:

1. At the Start of a Vendor Relationship:

- Request a W9 from any contractor or vendor your nonprofit works with toensure you have accurate records for 1099 reporting.

2. When Receiving Payments:

- If a nonprofit is being paid for services (such as renting out facilities), the payer may request a completed W9 to record the transaction correctly.

3. When Establishing Partnerships:

- Some grantors or corporate sponsors may request a Form W9 to verify your tax-exempt status before issuing funding.

How a Nonprofit Normally Completes a Form W9

Filling out a Form W9 for your nonprofit is straightforward when you follow these steps:

1. Download the Form:

- The Form W9 can be downloaded directly from the IRS website.

2. Fill Out the Basics:

- Enter the nonprofit’s legal name and any DBA name, if applicable.

3. Indicate Tax-Exempt Status:

- Check the “Other” box under Tax Classification and specify “501(c)(3).”

4. Provide the EIN:

- Use your nonprofit’s EIN instead of a Social Security Number (SSN).

5. Sign and Date:

- Ensure the form is signed by an authorized individual who can certify the accuracy of the information

How a Nonprofit’s Vendor Completes a Form W9

When your nonprofit hires vendors or contractors, you’ll need a completed W9 from them. Here’s what the vendor should do:

1. Provide Accurate Information:

- Vendors should complete the form with their legal name and TIN.

2. Specify Tax Classification:

- Vendors will check the appropriate box for their tax classification (e.g., sole proprietorship, LLC, etc.).

3. Sign and Return:

- Vendors should sign and date the form and return it promptly to your nonprofit for records.

Frequently Asked Questions (FAQs) About the Form W9 for Nonprofits

What is the purpose of a W9 form?

The W9 form provides a taxpayer’s identification information, enabling the requesting party to file information returns like Form 1099 correctly.

Who can sign a W9 for a nonprofit?

An authorized representative of the nonprofit, such as the executive director, CFO, or board member, can sign the form.

How to fill out a W9 as a nonprofit?

Complete the form by entering the nonprofit’s legal name, EIN, and indicating “501(c)(3)” under tax classification.

Where can I find a W9?

The Form W9 is available for free on the IRS website.

Is a W9 required for a nonprofit?

Yes, nonprofits may be required to provide a W9 when receiving payments or entering into agreements with payers.

Is a 990 the same as a W9?

No, Form 990 is an annual informational return filed by nonprofits with the IRS. The W9 is a form used to provide taxpayer information.

What is the dollar limit of a W9?

A W9 is typically required for payments of $600 or more in a calendar year to contractors or vendors.

What number should I put on my W9?

Nonprofits should provide their EIN (Employer Identification Number) on the W9.

Do I always need to request a W9?

Yes, it’s best practice to request a W9 from any vendor or contractor your nonprofit pays.

What if someone refuses to complete a W9?

If a vendor refuses to complete a W9, you may need to withhold 24% of the payment as backup withholding and remit it to the IRS.

Ready to Take the Next Step?

Navigating tax compliance can feel overwhelming, but you don’t have to do it alone. Schedule a discovery call with our team to learn how we can support your nonprofit with accounting, tax, and CFO services.

Let’s work together to help your organization thrive!